Record, Delete, or Edit a Sales Tax Payment in QuickBooks Online

Contents:

Go to the + New menu, then select Receive payment. Click the checkbox for the payment you’ve received. Get a dedicated team of QuickBooks-certified bookkeepers to set up, import, and categorize all your transactions for you.

- https://maximarkets.world/wp-content/uploads/2019/03/MetaTrader4_maximarkets.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/logo-1.png

- https://maximarkets.world/wp-content/uploads/2020/08/trading_instruments.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/Platform-maximarkets-1.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/forex_education.jpg

Then select ok to confirm the removal of the payment. From thePayment account ▼drop-down, select thebank accountwhere you deposited the overpayment. There are two possible reasons you’re seeing this Overdue amount.

Quickbooks desktop How to clear a customer overpayment from open invoices after creating a credit memo and refund check

Allow me to chime in for a moment and share additional information about where to deposit the expense you’ve matched with zero payment. Create a check transaction and in the place where you normally enter what expense it is for select Accounts Receivable. SelectMinor Charge-Offin the Item field and enter the amount of overpayment.

This will remove all the customers with zero balance. Furthermore, using Dancing Numbers saves a lot of your time and money which you can otherwise invest in the growth and expansion of your business. It is free from any human errors, works automatically, and has a brilliant user-friendly interface and a lot more.

ConEd bilked the MTA on electric bills for years — to the tune of at least $7M: IG – New York Post

ConEd bilked the MTA on electric bills for years — to the tune of at least $7M: IG.

Posted: Sun, 08 Jan 2023 08:00:00 GMT [source]

Check outresolve a payroll tax underpayment. Are you seeing a negative tax amount in your payroll product, or have a credit notice from the IRS or state agency? We explain how to resolve tax overpayment issues.

Customer Transactions

When the debit bank transaction was pulled in automatically by QBO, I matched it with the refund receipt. Then followed the Refund Receipt workflow to record the payment of $50 to customer. A customer paid $200 on an invoice of $150 i.e. they overpaid $50 on the invoice.

Are you struggling to get customers to pay you on time, or… To start, may I know what’s causing the over payment? If the over payment is because of the exchange rate you’ll need to transfer the amount to the exchange gain and loss. If not, you’ll need to include the amount as your income. It’s my pleasure to help you remove/handle the over payment in QuickBooks Online .

Thanks for posting and have a wonderful day. In theOutstanding Transactionssection, make sure that the correct invoice is selected. The bank balances match all fine, but I have the negative entry in the AR.

Accountants & Bookkeepers

Under the Outstanding https://bookkeeping-reviews.com/ section, select the checkbox for the Expense or Check you created. Scroll down towards the Credits section and select the credit memo. So there is no payment to be received in the original invoice. Select the same bank account used in processing the refund.

You can make acompleted contract method meaning, examples Deposit. You can follow the steps provided by my colleague,Bryan_M, by depositing the invoice payment. Record the second, duplicate payment as a deposit. Select A/R as the account on the deposit and make sure to select the customer under ‘Received From’. This will book the overpayment as a credit on their account without needing to create a credit memo which, obviously, you don’t want. In your situation, you can include the overpayment in the Receive Payment screen.

Plano based Computer/IT Training Company

Use a credit balance adjustment to apply the overpayment as a payment to subsequent invoices. Use a negative invoice charge to apply the overpayment as a credit to a future invoice. Return funds to the customer and do not record any credit balance or negative invoice credit in Zuora. If you intend to keep the overpayment as income, create a Tip income account and a Tip service item assigned to the Tip income account. Then, create a new invoice for the customer using the Tip item and the overpayment amount.

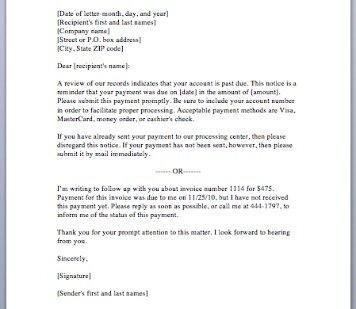

You need to leave the current page and revisit the Taxes menu where you would be able to locate the tax payment that you have deleted are not appearing anymore. If you had already deposited the refund check, follow the above steps, but then you’ll need to make a journal entry in order for your bank to reconcile. Simply debit whatever account you used when you deposited it and credit Cash for the amount of the check. Customers can pay you too much for several reasons. When this happens, you can use the credit toward an invoice, refund the customer, or enter the overpayment as a tip in QuickBooks. Select Receive payment or Receive invoice payment.

This feature allows you to share bills, payments, information, and much more. First of all, Click the Import available on the Home Screen. For selecting the file, click on “select your file,” Alternatively, you can also click “Browse file” to browse and choose the desired file. You can also click on the “View sample file” to go to the Dancing Numbers sample file. Then, set up the mapping of the file column related to QuickBooks fields.

Unfortunately, on QuickBooks Online, you cannot edit tax payments. If you wish to do so, you would be needing to delete the payment and start recording a new one. The first one of which is recording tax payments and the following steps will detail out how to execute the same in QuickBooks Online. It makes sense to handle it this way, however, QBO will NOT accept the overpayment, no matter how many times I try to change it.

Features of Dancing Numbers for QuickBooks Desktop

Then, apply the Charge-off Account created to clear the small amount. Choose the customer you want to receive the payment from. I understand your frustration and I know how important it is to accurately record transactions in QuickBooks Online .

First is overpayments for the customers’ refund. As mentioned by @Malcolm Ziman, you can choose any bank on the deposit to field since you’re just offsetting the unapplied payment . Before matching the invoice overpayment, you’ll need to record it first through Receive payment by entering the exact amount paid by the customer. What if I’m not refunding the customer (I mean realistically, they don’t care about getting 1 cent back). If I issue a refund, it messes with my actual income received, bank balances and reconciliations.

Save the transaction and apply it by receiving a payment. When making payments to bills, what does the CLEAR PAYMENT option do? It’s my pleasure to explain to you what the clear payment option in QuickBooks Online is for. Clicking the Clear Payment button on the Bill Payment will make the transaction zero or clear, and the bill active again.

Whatever “bank” I choose the money shows up there as an additional amount. Maybe I am doing something wrong–created expense against A/R, then receive payment choosing that expense. But the deposit to is creating a stumbling block for me. You can resolve some payroll tax overpayments in your payroll product to correct your reports and tax forms. Select your payroll plan below for instructions.